The nursing home lobby operating in Washington and state capitals is continuing its long running financial hardship campaign. An article in the latest issue of Provider (the main propaganda organ for the industry) claims that COVID presented such a serious financial blow to providers that enhanced financial assistance from government would be the only way to implement needed substantive reform. The reform needed, according to the article, is due to increasing demand in long term care services (Patrick Connole, “COVID Challenges Bring Opportunity for Systemic Changes,” June 2020, 9-10).

The article states that “With the majority of nursing homes already operating on razor-thin margins, the cost of making improvement will not be possible without financial assistance.” Perhaps the razor thin margins to which the author is referring apply to the LLC listed as the owner and not to all the other LLCs such as the property LLC, the management LLC, the rehab LLC, the medical transport LLC, etc. Certainly, holding companies and REITs have not fared badly at all during 2020 and the height of the COVID pandemic.[i]

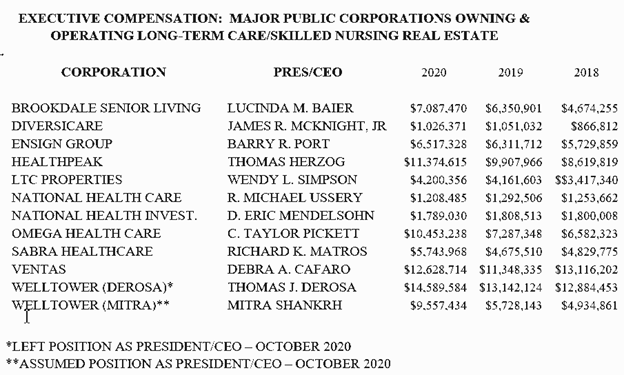

One would think that the entities at the top of the financial food chain would have taken a major hit and pared back their CEO pay considerably if the razor thin margins at some point in the flow of capital diminished shareholder value. However, as the table below suggests, CEO pay for major nursing home operator/real estate chains listed on a public exchange were either enhanced by a large amount over 2019 and 2018 or remained steady.

The above table does not display the proportion of total pay that is due to an “incentive bonus.” Nevertheless, in cases where a major increase year over year appears for an executive, a large amount is for performance, which one must assume is financial performance. The loss of life throughout the companies overseen by the executives in the table was a historical first for institutionalized U.S. populations. An estimated 132,000 to 140,000 people in the care of these CEOs unnecessarily lost their lives.

The government funded companies headed by CEOs at issue in this blog post are increasingly powerful players in taxpayer subsidized long-term and skilled nursing. In blog posts ahead, I will be discussing the growth of their power and influence. For instance, the ManorCare property sold off by the private equity firm The Carlyle Group is now owned by Welltower and operated through a Welltower-Pro-Medica joint venture.

In the future, I will be blogging about the convoluted ownership structures in the nursing home industry and the complexification of that facet of the business due to the creativity of corporate lawyers and financial experts. Without exposing the financial trickery employed by providers, the public will be victimized by falsehoods of lobbying groups such as the AHCA/NCAL and others.

NOTE: The data in this post were derived from proxy statements filed with the Securities & Exchange Commission. In the future, I will be discussing compensation for board members and other officers/executives of major LTC/SKn corporations.

[i] Kingsley DE, Harrington C. COVID-19 had little financial impact on publicly traded nursing home companies. J Am Geriatr Soc. 2021;1–4. https://doi. org/10.1111/jgs.1728