As I noted a couple of days ago, The Ensign Group (Ensign) was scheduled to release its 4th quarter financial report and hold a conference call. They did that. This blog post will provide a basic overview of their 4th quarter and annual results.[1] I will be reporting on the Centene Corporation and the real estate investment trusts in the weeks ahead.

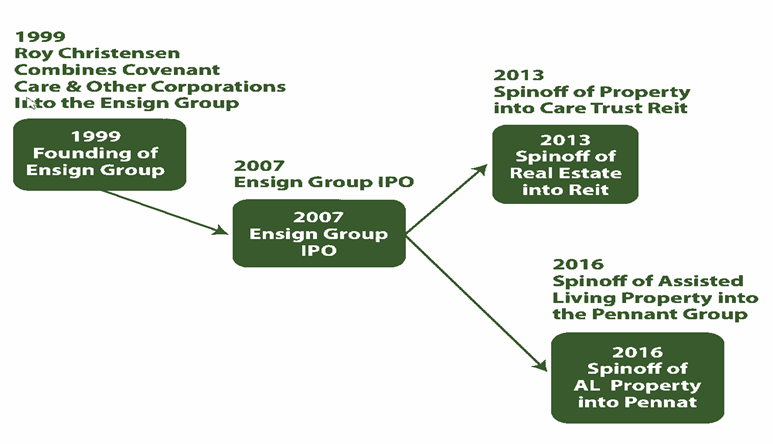

It is important to note that the late Roy Christensen, Ensign founder, and current/past Ensign executives were and are very sophisticated financiers. Christensen founded Beverly Enterprises in the 1960s, sold it, and taught business at Brigham Young University until he founded the Ensign Group in 1999. Most Ensign executives and board members have an association with the Marriot School of Business at BYU. There is no other nursing home corporation like the complexly organized Ensign. It is becoming increasingly complex to the advantage of shareholders and executives but apparently not to taxpayers, patients, and employees (as I will demonstrate below).

Highlights of Ensign 4th Quarter Results

- Earnings per share of $4.14 – an increase of 13.7% over the prior year.

- Earnings per share for the quarter of $1.06 – an increase of 23.3%.

- Consolidated revenues for the year were $3.025 billion – an increase of 398.5 million or 15.1% over the prior year.

- Net income was $60.5 million for the quarter – an increase of 24.1% over the prior year quarter.

- For the year, adjusted net income was $235.7 million – an increase of 13.8% over the prior year. Given an annual 2022 revenue of 3.025 billion and a net income of $235.7 million, percent net income was 7.8%. However, Earnings Before Interest, Taxes, Depreciation & Amortization EBITDA – a more important cash flow statistic – was $383.5 million or 12.6%).

- The company’s liquidity is increasingly strong with $316 million in cash and cash equivalents on its balance sheet and a $593.3 million line of credit.

It’s All About the Real Estate

Quarterly reports, annual reports, and proxy statements can become eye glazing for the public. The way we need to look at Ensign and the rest of the nursing home industry is this: Medicaid and Medicare (mostly Medicaid) provide revenue that sustains a real estate industry. Hence, direct care services are robbed for the sake of shareholder interests.

In the past couple of decades, tax code adjustments have resulted in a financial transformation of long-term and skilled nursing business. Limited liability entities, private equity firms, real estate investment trusts, and individual/family trusts have blossomed like tulips in Springtime. Ensign is a cutting-edge bellwether of financialization, and the tax arbitrage associated with it. Let’s take the separation of property from operations (OPCO/PROPCO).[2] Property has been increasingly separated into separate subsidiaries of parent corporations or sold to REITs and leased back. However, Ensign has upped that game. The following indicates the segmentation of the company into separate entities – most of which were not discussed in the quarterly report.

The above graphic does not include a couple of later entities – Standard Bearer (a captive[3] REIT) and a captive insurance company.[4] A spinoff has tax advantages for shareholders. Added advantages for Ensign in its spinoff of property into CareTrust REIT include avoidance of capital gains taxes and increased corporate assets/value. CareTrust is an “umbrella partnership real estate investment trust,” otherwise known as an UPREIT. By transferring property to an UPREIT, rather than selling it, capital gains taxes are avoided, the transferee receives “operating units” (OPUs), and receives returns from the triple net leases to other nursing homes (under triple net leases, leasees pay insurance, maintenance, and taxes – what a deal!).

As the above diagram indicates, Ensign undertook a spinoff in 2016 by spinning out its assisted living facilities into the Pennant Group – an Ensign spinoff. Ensign leases property to the Pennant Group and retains a major share of the stock. This model illustrates the OPCO/PROPCO set up in which property becomes a tradable commodity rather than a necessary tool for producing care. Finance dominates production.

Financialization

Financialization throughout the U.S. economy has dampened economic growth. Furthermore, stagnant wages, a diminishing upwardly mobile middle-income class, wealth transfer to super-rich individuals and corporations, and a low-wage underclass are due to the separation of finance from productivity.[5] Nowhere is that phenomenon more apparent than in the U.S. government-funded healthcare system. The massive real estate substrate of industrialized medical care is draining resources from care. There is no rational justification for exceedingly low pay, and poor care when so few are making so much from the trillions of dollars poured by Americans into the health care system.

Summary

From a financial and technical perspective, this post has been somewhat superficial. Nevertheless, we need to outline the overall financialized, industrialized, government-funded U.S. healthcare system and have a very serious public conversation about how the hardworking and patriotic people of the U.S. are being fleeced. I will be clarifying and filling in the concepts that I have introduced in this post. In the future you will see more regarding UPREITs and OPUs, shell companies (Ensign has over 400 subsidiaries, all are LLCs, all incorporated in Nevada), and other financial machinations that are robbing American taxpayers.

[1] You can listen to the conference call and download the text of the call here: https://investor.ensigngroup.net/news-releases/news-release-details/ensign-group-reports-fourth-quarter-and-fiscal-year-2022-results

[2] For a very good discussion of REITs, Financialization, and nursing homes, see Rosemary Batt & Eileen Applebaum (July 9th, 2022), “The Role of Public REITs in Financialization and Industry Restructuring.” Working Paper No. 189. Washington, D.C.: Institute for New Economic Thinking.

[3] A REIT with the property of only one corporation – The Ensign Group in this case.

[4] An insurance company that underwrites only the entity that incorporates it.

[5] For a very good discussion of financialization, see: Rana Foroohar (2017), Makers and Takers: How Wall Street Destroyed Main Street. New York: Crown Publishing.