Nursing Home Companies are Making Money but are Not Telling Taxpayers the Truth About it. Our Deductive Reasoning Skills Can Easily Reveal the Truth.

Welltower Corporation is a major player in the nursing home industry. Indeed, it is the dominant player. The major share of its $4.72 billion in 2021 revenue is provided by U.S. federal and state governments – from the taxpayers of America. Their business is senior housing real estate and medical care for people residing in their nursing home properties.

The public has a right to expect that medical care is the overriding mission of corporations involved in tax funded nursing care. That is not how Welltower executives view their role in the privatized, publicly funded, healthcare system. In their 2021 annual report they stated, Our primary objectives are to protect stockholder capital and enhance stockholder value. We seek to pay consistent cash dividends to stockholders and create opportunities to increase dividend payments to stockholders as a result of annual increases in net operating income and portfolio growth (https://welltower.com/wp-content/uploads/2021/04/2020-Annual-Report.pdf, p. 2, accessed 5/21/2022).

Welltower is one of the few nursing home companies listed on a public stock exchange. As their annual reports and the value of their stock in the current market crash indicate, they are achieving their financial objectives. As the Dow, S&P, and NASDAQ have tanked in the past few months, shares of publicly listed nursing home-related corporations are at, near, or above their value in late November when the markets began to sink at significant and at times precipitous rates.

These are solid corporations loaded up with commercial real estate, the value of which is enhanced by guaranteed revenue through Medicare, Medicaid, and generous tax advantages – gratis the U.S. taxpayers. This is the reason asset managers such as BlackRock and Vanguard have guided $billions of pension, sovereign wealth, and family office, funds, overseen by institutional investors, into asset-laden nursing home companies. As the markets fall, they are not moving money out of these equities and seeking a safer haven (In a blog post today, I provide an analysis of the stock performance of nursing home and other government-funded medical care corporations between the end of November 2021 and the end of May 2022).

The Big Lie from the Nursing Home Industry: “We Aren’t Making Enough Money to Provide Medically Ethical & Humane Care.”

Thousands of privately held corporations in the form of Limited Liability Corporations, Limited Partnerships, and other legal structures own from a few to a hundred or more nursing homes. Examples include, the privately held Pruitt chain, Diversicare, and several other substantial chains operating in various parts the United States. Years of interviewing employees, families of patients, reading inspection reports and media accounts, have convinced me that medical care in these facilities is substandard to nonexistent. Abuse and neglect are pervasive. Most of the care is provided by medically nonqualified and extremely low paid nursing assistants. Generally speaking, these are inhumane institutions. The thought of ever ending up in one is horrifying to most people.

Industry Prevarication & Misinformation about High Investor Returns

Although, evidence overwhelmingly suggests that investors are reaping huge returns from shoddy care, the American Health Care Association (AHCA) – the major industry lobbying firm and industry propaganda arm in Washington and the 50 states – successfully promotes a big lie: “provider net income is so low that they can’t treat patients humanely or pay higher salaries and wages.” On its face, that is absurd. But apparently it hasn’t dawned on legislators, bureaucrats, and the media that investors wouldn’t be investing in a venture with low returns while so many opportunities for high returns are available in the financial markets.

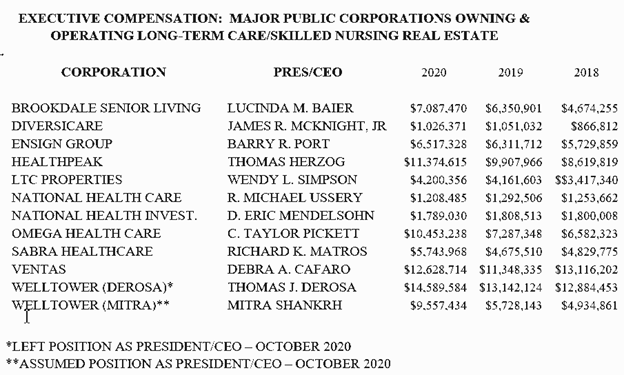

My colleague, professor Charlene Harrington, and I have debunked that argument as it pertains to publicly listed companies. We, like the rest of the public, have access to financial statements required by the Securities and Exchange Commission (SEC).[1] However, we do not have access to consolidated financial reports for privately held companies. We can’t see their income statements, balance sheets, or cash flow statements. Therefore it is very difficult to evaluate industry claims regarding earnings – difficult but not impossible.

Each of the approximately 13,000 facilities licensed to provide nursing care and certified to be reimbursed by Medicare and Medicaid are required to submit “cost reports, which include revenue, expenses, net income, and a host of other financial metrics. With the exception of California, these CRs are difficult to obtain. But we have now gained access to every filed CR in the U.S. Our analysis so far is telling us that the low net claim is a big lie; that fraud is rampant; and, that states are failing to audit the reports.

Low Risk, High Return Fueled by Government Funds with Little Financial Oversight: the Reality of Nursing Home Investing

As we pour over CRs – mostly in California, New York, North Carolina, and Kansa – we see reported net income as a fiction. We have also come to believe that the low 2020 net of .5% claimed by AHCA and its hired propaganda accounting firm Clifton, Larson, and Allen (CLA) is scurrilous nonsense – unbecoming of the 8th largest accounting firm in the U.S.

As one example, misinformation, if not outright fraud, is replete in the CRs of 25 Kansas facilities owned by Florida based private equity firm Windward Health Partners, LLC. Although the average net income reported by these facilities is 8.6% – far higher than the average claimed by AHCA & CLA – they are not reporting payments to their own property LLCs. Also, their chain goes goes by the name of Mission Health Communities. What they don’t note on their CR is that MHC is a related party – a management LLC set up as a company they own and are paying to manage their facilities. Hence their net is drastically lowered due to payments to other companies they own.

Although Mission Health Communities is falsely noted as the owner of these facilities, it exists as the typical private equity squeeze forced on victim companies. Mission Health Communities is paid a management fee but is, in reality, a separate LLC in the Windward Health Partners portfolio. That payment, along with a lease payment to a property LLC, and perhaps other payments to Windward owned ancillary services such as therapy, are expensed on the income statement. In effect, these facilities are making payments to entities owned by their parent corporations and reducing their net income reported to the State of Kansas.

According to CRs submitted by Windward, Kansas taxpayers paid the company $103,403,493 in total 2020 revenue. Because of omitted information and opaqueness of the system, only company insiders know how much cash flowed out in the form of lease payments, management fees, and possible other ancillary services. The 25 facilities received an average of $249,063 in COVID relief payments. I say cash because these payments to itself is gravy for partners and limited partners in Windward Health Partners, LLC.

Democracy & Medical Ethics

The people of Kansas have no idea about how their tax dollars are flowing out of their state into investment firms like Skyway Capital Partners of Tampa Bay, Florida – the financial firm that has capitalized Windward Health Partners. That is not because Kansas residents are dumb. Rather they don’t know how government funds flow from facilities to parent corporations structured as private equity, LLCs, C and S corporations, and limited partnerships, because the system is designed to operate behind a veil of secrecy. For the most part, the Kansas legislature and state bureaucrats have been captured by the industry.

Employees at the Kansas Department of Aging & Disability Services are far more protective of industry financial secrecy than they are of the public’s right to know how their tax dollars are being utilized. The deck is stacked in favor of the industry. Getting substantive information from KDADS is like getting red meat out of a tiger cage.

Medical care is substandard in nursing homes across Kansas but shareholder value overrides medical ethics. Indeed, you will be hard pressed to find a physician around a nursing home at any given time. You will also be hard pressed to find more than a hand full of physicians who really give a damn about what goes on these institutions. The medical profession is silent, the bioethics profession is silent, and the voters are kept in the dark. That’s not how democracy is supposed to work.

[1]Kingsley D, Harrington C. (2021) “COVID-19 had little financial impact on publicly traded nursing home companies.) J Am Geriatr Soc. 2021;1–4. https://doi; Kingsley, D Harrington, C. “Financial and Quality Metrics of A Large, Publicly Traded U.S. Nursing Home Chain in the Age of Covid-19, International Journal of Health Services, 1-13, https://doi: 10.1177/00207314221077649.