By:

Dave Kingsley

What is U.S. Policy Regarding a Living Wage for Healthcare Workers

It is difficult to establish exactly what CMS and state agencies are doing these days to audit, investigate, and regulate the nursing home industry. But I think we can safely say that it is very little. One thing we know is that the long-term care business is labor intensive. Hands on, direct care is the sine qua non of nursing home operations. Without the workers who risked their lives during COVID (approximately 2000 died because of the pandemic), corporations could not have continued to earn robust returns for their investors.

Labor issues in the nursing home industry are escaping notice of legislatures, the media, scholars, and reform commissions. Consequently, the public in general is unaware of the injustices perpetrated on workers in the form of poverty wages and poor working conditions – including violation of labor rights under the National Labor Relations Act. Although operators were provided with lavish amounts of COVID relief, it appears that workers did not share in these allocations even when large amounts of revenue were extracted on behalf of investors.

High Poverty Areas of the U.S. and Poverty Wages: The Injustice of Place and Internal Colonization

Large regions within the United States such as the Mississippi and Arkansas Deltas, South Texas, and Appalachia, and large ghettos and barrios are beset with high levels of poverty, low economic development, and a dearth of opportunities through education and upward mobility. These areas lack cultural amenities and healthcare access. The poor whites residing in the poorest areas of the U.S. have been losing ground in their overall health and life expectancy. In some places, people of color are in the majority and have historically had poor health care access and shorter lives.

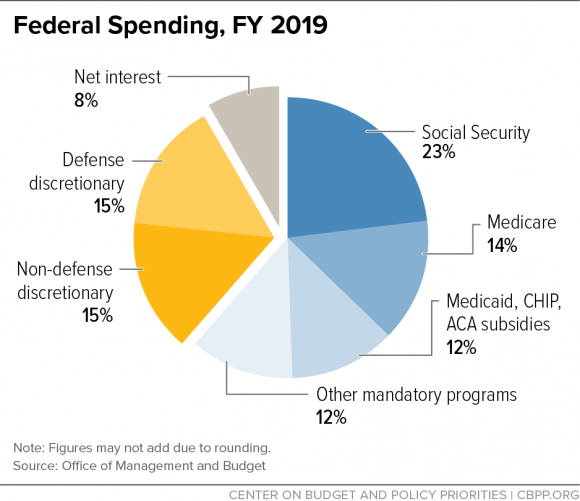

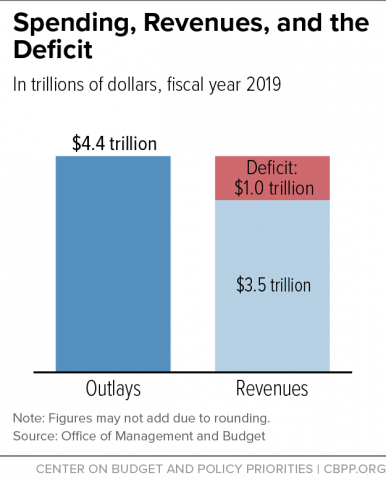

One would think that an injection of government funds through long-term care services and other healthcare programs e.g., Medicare and Medicaid would significantly contribute to a rise in the standard of living in these impoverished, economically underdeveloped places. In other words, the trillions of dollars in federal and state budgets dedicated to healthcare should provide an economic boost to economically disadvantaged areas. However, rather than contributing to development of impoverished counties and regions, the long term care industry is exploiting them through excessively low wages.

Magnolia, Arkansas and the Greenhouse Cottages of Wentworth Place

Greenhouse Cottages of Wentworth, Magnolia, Arkansas

In my last blog post, I wrote about the shockingly low wages paid to CNAs doing 80% of the work in Alta Vista Nursing & Rehab – an Ensign Group facility (see “NAFTA and Working Home Wages in the Rio Grande Valley”). Most nursing home corporations along the corridor consisting of cities such as Brownsville, Harlingen, McAllen, and other cities with sister cities across a bridge to Mexico are paying poverty wages while extracting robust amounts of earnings and COVID relief money (more about them in a later post).

I am hypothesizing that pricing and reimbursement of industry for services are uniform across states without regard for the price of labor and yet set a floor under returns to the industry that advantages investors. Conversely, labor costs are allowed to float in local labor markets. This is an injustice. Labor in poor areas is suppressed while rich areas benefit from wages at the high end. As I collect data on wages, hours, and working conditions in the nursing home industry, I’m seeing this pattern. Let’s take Greenhouse Cottages of Wentworth Place in Magnolia, Arkansas as an example.

Magnolia is a community of 10,000 people located in Columbus County, Arkansas, which is one of the poorest counties in Arkansas with poverty level nearing 25%. The county is not far from the Louisiana border in South Central Arkansas. Greenhouse Cottages of Wentworth Place is a large facility with 135 beds and 2022 revenue of $11,648,420. Based on its income statement, the facility had operating income (operating net) of $719,547.

In addition to operating income, $522,998 in nonpatient revenue from COVID relief was noted on the facility’s income statement. Hence, with a net income of $1,242,998, the company had a 10.7% net income in 2022. However, the company claimed $7,198,189 in expenses to its real estate entity, therapy services company, home office allocations, and employee leasing (i.e., outsourcing labor to its labor contracting service). $6,163,519 of claimed related parties expenditures were allowed by the state.

Wages at the Greenhouse Cottages of Wentworth

An examination of wages for the Greenhouse Cottages of Wentworth reveals exceeding low nursing wages for a company with an impressive net income and huge payouts to subsidiaries of the parent corporation. In 2022, the average RN wage was $34.48. Looking at RN wages at the facility for years 2016 through 2022, the average hourly wage for RNs increased from $31.62 to the 2022 wage of $34.48. If $31.62 in 2016 kept pace with inflation, it would be equivalent to $39.61 in 2022.

In 2016, CNAs were paid $10.57 at the facility. That low base amount rose slightly above inflation over the years ($13.93 versus $12.49 in 2021). In 2022, CNA pay averaged $15.71 due to President Biden’s Executive Order raising the minimum wage for federal contractors to $15.00 per hour.

Over the three years that COVID was raging, the facility received $3,548,321 in COVID relief. There is no evidence that this was shared with the workers. I suspect that we will find that to be a standard practice throughout the nursing home industry.

Is a Huge Increase in Reimbursement Justified without Consideration of Workers

As lobbyists and propagandists for the industry with negligeable pricing research and evidence continue to claim that reimbursement is too low, CMS proposes that operators be rewarded with a $2.2 billion increase due to a 6.4% “net market basket update to the payment rates” (see “CMS SNF Final Rule Seen as Insufficient for Payment Rates While Advancing Unfair Measures, Skilled Nursing News, July 31,2023). Given massive amounts of COVID relief funneled into the industry and ongoing subpar pay for the direct care workforce, we need clear and decipherable data and rationale for this increase.