Monetary Policy & The Rising Stock Market

Most Americans are perplexed about rising stock markets during the current economic collapse. As someone with an avid interest in the history of economics, I can say with a high degree of confidence, this is a first. But when you consider the evolution of the U.S. economic system over the past 50 years, monetary and fiscal policy have been incrementally arranged to support investors and reduce protection for workers and consumers.

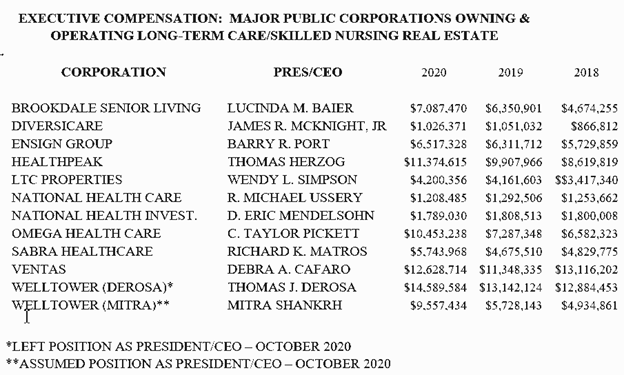

Indeed, the history of the “nursing home” industry reflects these macroeconomic changes. Advocates and activists should consider the trend toward financialization of corporations in all businesses and prepare a legislative agenda accordingly. I will return to the nursing home industry later in this post. First, I want to explain the phenomenon of a roaring stock market in an economic collapse.

As I’ve been pointing out for months, the Federal Reserve can create an unlimited amount of money and make it available to lenders and corporations. The Fed can do that in several ways. One way is to buy debt from banks and corporations. Where do they find the money to do that? They create it with keystrokes (that’s a metaphor for an accounting gimmick). It can lower interest rates to practically zero and invite banks to borrow. It can lower bank reserve requirements and allow for increased lending at very favorable interest rates for borrowers.

In a front page article yesterday (8/19/2020) entitled “The Market Is Nuts: Stocks Defy a Recession,” the New York Times finally decided to provide a partial explanation of the realities of contemporary government policy, which amounts to nurturing of concentrated wealth at the expense of most Americans. If you read the article to the end, you will find this coming from Michael Hartnett, chief investment strategist at Bank of America Global Research:

“The performance of the market in the face of such dire expectations for growth, he wrote, is just the latest example of investors betting that low growth will prompt the Fed to continue to pushing (sic) money into the financial system, ultimately bolstering stocks. In other words, stocks are going up not because of economic optimism, but the future looks fairly grim. Mr. Hartnett titled his report, ‘I’m so bearish, I’m bullish.’”

https://www.nytimes.com/search?query=%22This+Market+is+nuts%3A+Stocks+Defy+a+Recession%22

Nursing Home Corporations Will Come Out Just Fine

Publicly listed nursing home companies are enjoying the current bull market. I checked The Ensign Group’s stock on the Nasdaq yesterday (ESNG). It closed at $56.50 per share – near its all-time high. In March, it was trading as low as $29.

Furthermore, The Ensign Group second quarterly report indicates strong earnings:

“We are pleased to report that despite continued unique challenges presented during the current global pandemic, the operational momentum we experienced in the first quarter continued into the second quarter where we again achieved record-breaking results. While there were many things that contributed to our strong results, we announced today that we returned all of the CARES Act Provider Relief Funds, which are meant to cover lost revenue and increased expenses tied to the COVID-19 pandemic. Therefore, our results do not include any benefit related to those distributions,” said Ensign’s Chief Executive Officer Barry Port. The Company indicated that, like other well-capitalized healthcare providers, they returned these unneeded provider grant funds. He continued, “As we said last quarter, this pandemic arrived at our doorsteps at a time when our organization had never been stronger clinically and financially

https://finance.yahoo.com/quote/ENSG/history?p=ENSG

Some of the big corporations in the business such as Genesis Health Care don’t appear to be faring so well, but that’s simply because they have been looted. A number of years ago, for example, Genesis was the victim of takeover artist Arnold Whitman’s Formation Capital. I’ll be writing much more about that in future blog posts.

In addition to government largess, companies like the Ensign Group can enhance free cash flow through low interest loans from their lending facilities. Available liquidity, plus the CARES Act, and Paycheck Protection Program will ensure that the skilled nursing business will land on its feet coming out of the pandemic.

No Better Place to Invest Your Money

An article by Alex Spanko in Skilled Nursing News yesterday (8/19/2020) with the headline “Skilled Nursing M&A Remains Active: Investors Don’t ‘Have a Better Place to Put Their Money’” indicates that the infusion of cash from Federal and state governments plus ongoing price supports makes it difficult to value real estate. This simply means that unlike the rest of the commercial real estate market, nursing home real estate is maintaining value due to factors unrelated to market forces (e.g. such as retail and office space).

Although bed occupancy has dropped during the COVID pandemic, unlike other commercial real estate, lessee revenue remains steady. Operators will be able to meet most or all of their lease payments. In most cases, real estate corporations are owned by the same holding company as the operator. Leases are favorable to lessors; hence, a partial modification of lease arrangements combined with the amount of cash infused into the business by governments will hardly lower overall revenue. As stated in Spanko’s article:

The question of valuations has become complicated by the vast influx of federal stimulus cash for skilled nursing operators. The Department of Health and Human Services (HHS) so far has earmarked nearly $10 billion exclusively for nursing home operators, on top of billions in Medicare- and Medicaid-based CARES Act relief tranches that providers can also access. Providers have also seen state-level bumps in Medicaid rates, and have been able to take advantage of the Paycheck Protection Program (PPP) and advance Medicare payment programs.

https://skillednursingnews.com/2020/08/skilled-nursing-ma-remains-active-investors-don’t-a-better-place-to-put-their-money/

Summary

The American economy has evolved increasingly toward financialization, which means that finance has morphed from a supportive ancillary function to a dominant business. No doubt, the primary business of the nursing home industry is finance rather than real estate and skilled nursing as has been the case historically. The difference between the thousands of corporations involved in skilled nursing and other financialized corporations is the maintenance of a price floor and generous supplemental payments without any relationship to quality of care or competitive performance in a market.

Due to a powerful, well-funded, and well-organized lobby, the industry has been able to capture government – both elected officials and agencies with an original mission of oversight. Agencies such the Center for Medicare & Medicaid Services and correlative state agencies protect the industry from public scrutiny while providing a veneer of oversight. State legislatures have propped up corporations in the skilled nursing business in spite of their low quality and neglectful care for patients.